Customer login to merchant’s apps/ website and proceed to checkout

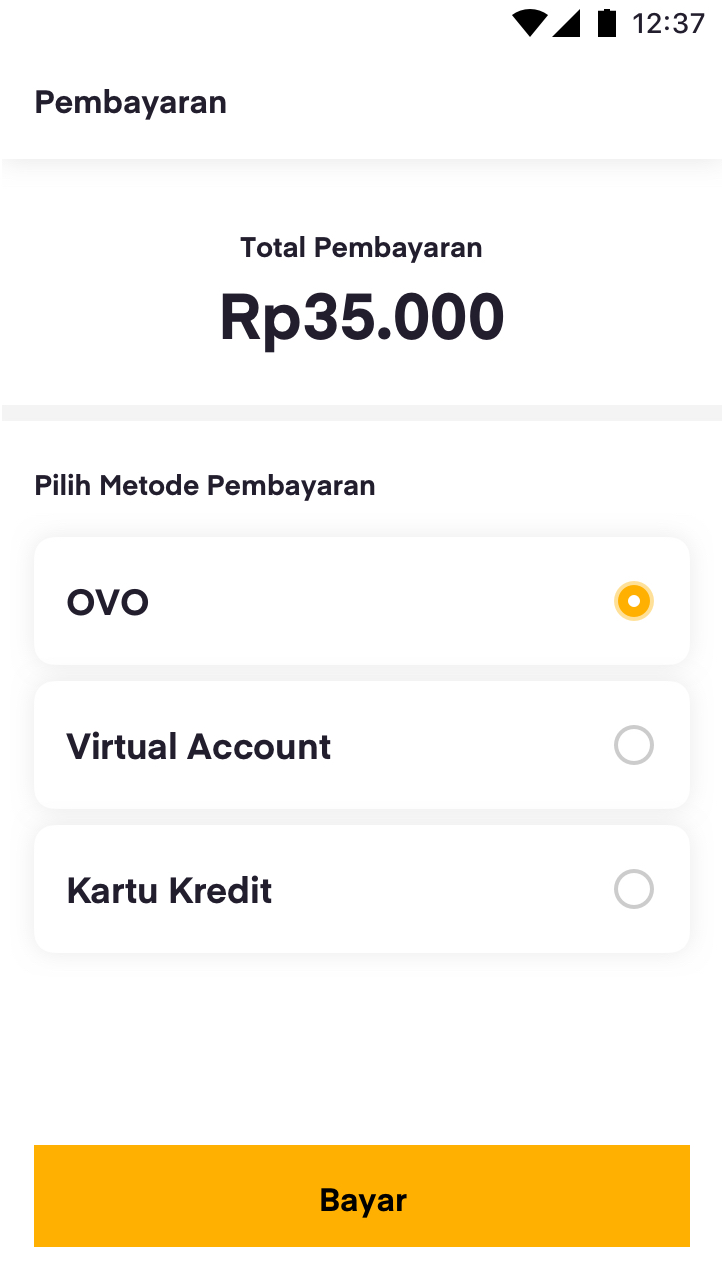

Customer select OVO as the payment method in merchant's app/ website

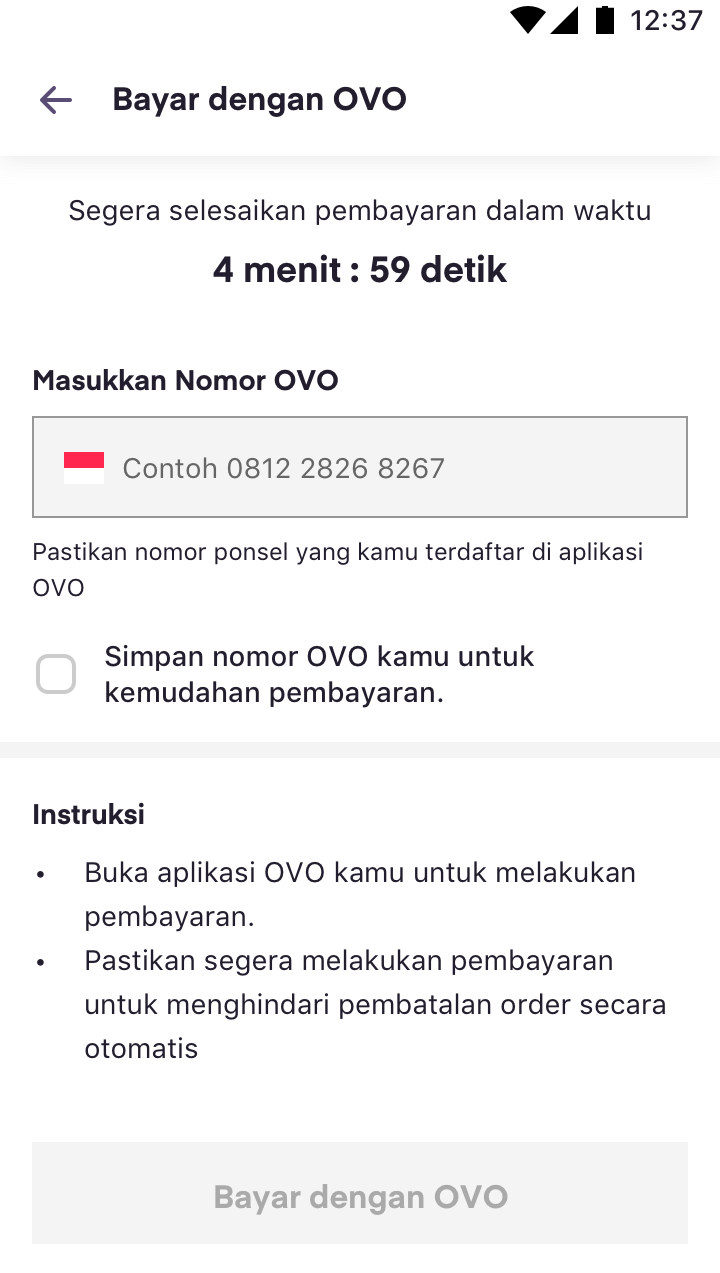

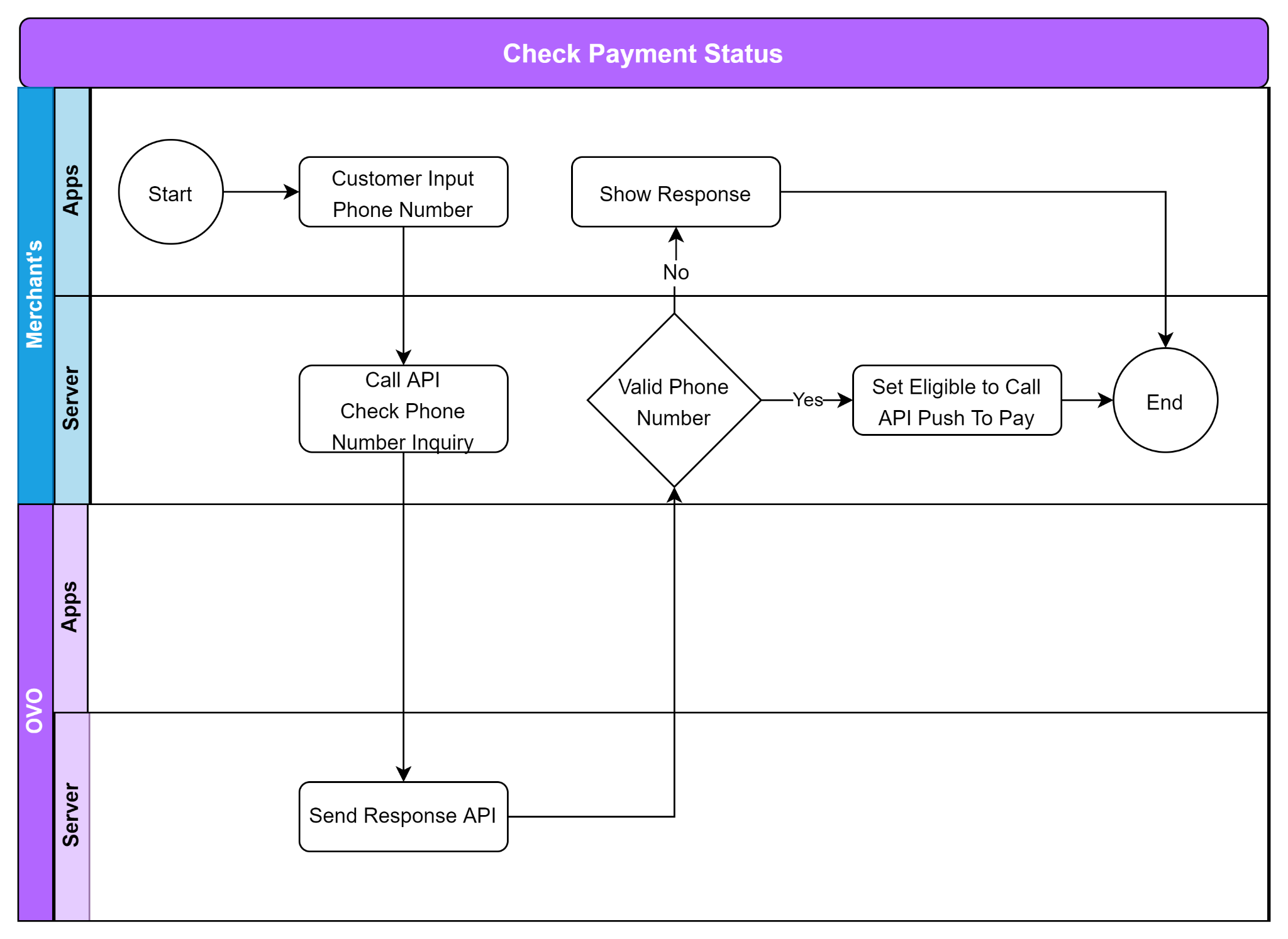

User submit their phone numbers that has registered in OVO account

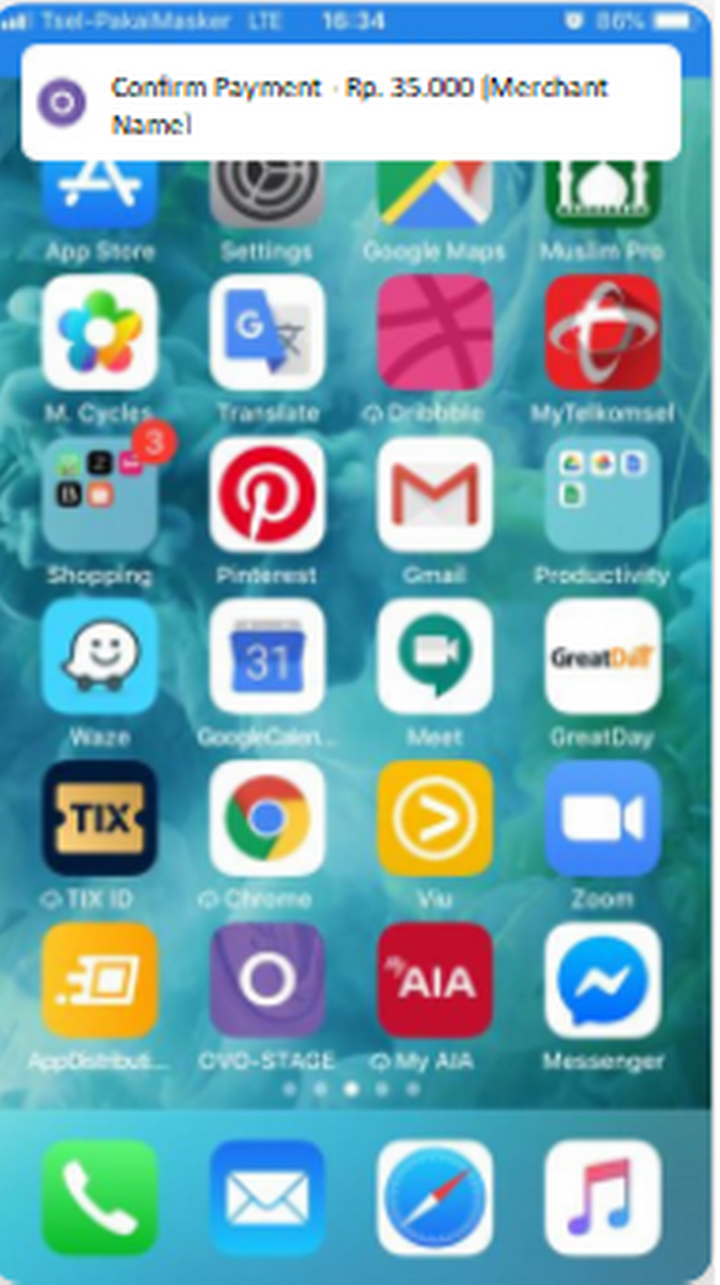

Customer will receive Push to Pay Notification in their device

Customer check the payment summary, the amount, and source of fund

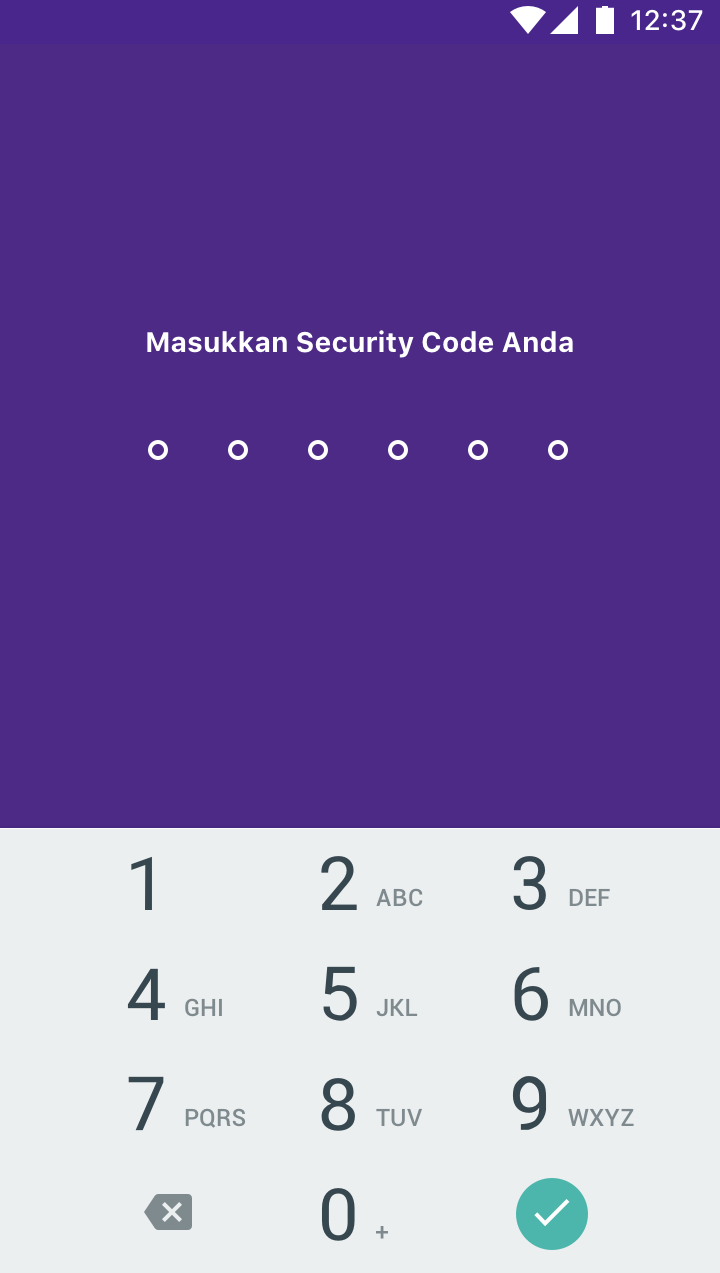

Customer input their security number

.png)

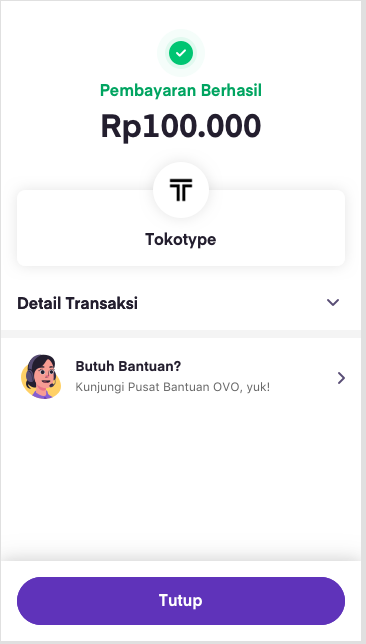

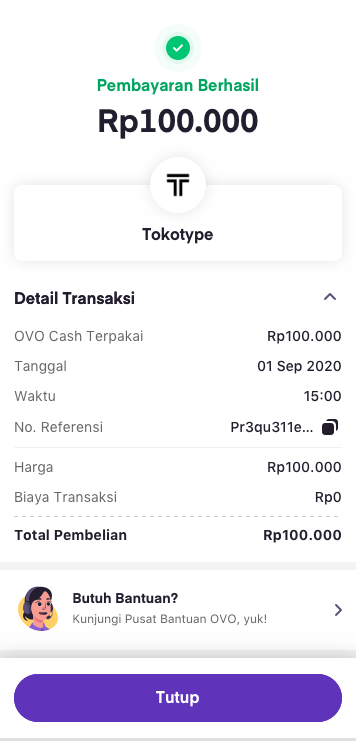

Transaction status in OVO App

Merchant’s app/ website shows complete/failed transaction by RC Code

Merchant should be able to inform the user that the number should be registered in OVO

Instruction for user:

Enter your registered phone number in the OVO application with the 08xxx format.

First sentence:

1. Open your OVO application and click the bell icon complete the payment.

2. Make sure you complete the payment with a specified time limit to avoid transaction timeout.

Second sentence:

Open your OVO application and click the bell icon to complete the payment. Make sure you complete the payment with a specified time limit to avoid transaction timeout.

Merchant should be able to inform the completion status to user

Please put clear error message for every response that will be given by OVO

| Response Code (RC) / HTTP Status |

Description / Message |

|---|---|

| RC 00 | Payment successful. |

| RC 14 | The phone number isn’t registered to any OVO account. Please try again. |

| RC 17 | Transaction canceled by User. |

| RC 26 | Failed Push notif to users, please make sure users login to OVO app first. |

| Timeout / Merchant not get Response | Transaction failed due to timeout. Please try again. |

Sample of the expected implementation on online integration

RC 00

Payment Successful

RC 00

Payment Successful

RC 17

Canceled Payment

RC 17

Canceled Payment

RC 14

Invalid phone number

RC 14

Invalid phone number

Timeout/Merchant not get Response

Merchant will need to add the requirement API for online Push To Pay

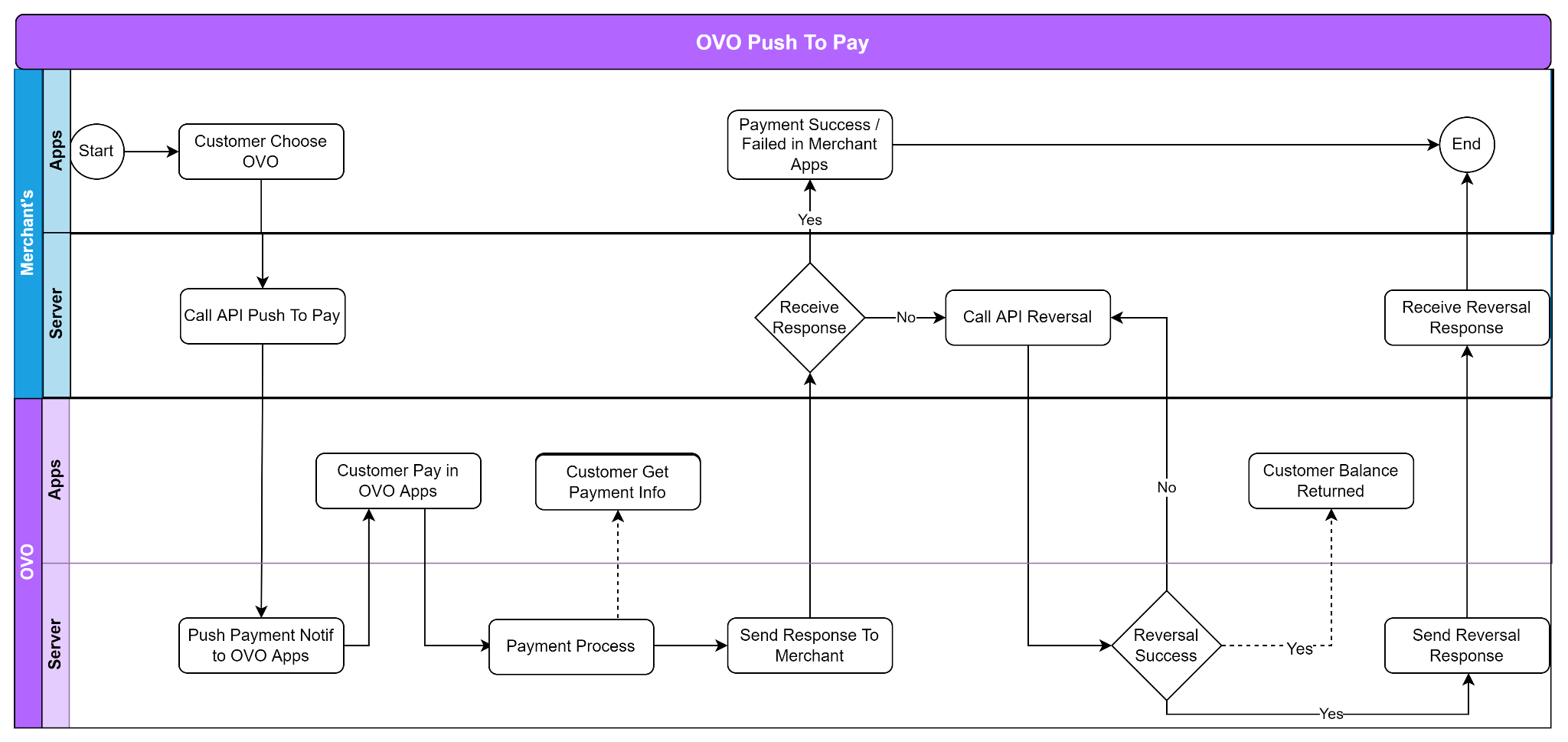

Online Payment Technical Flow

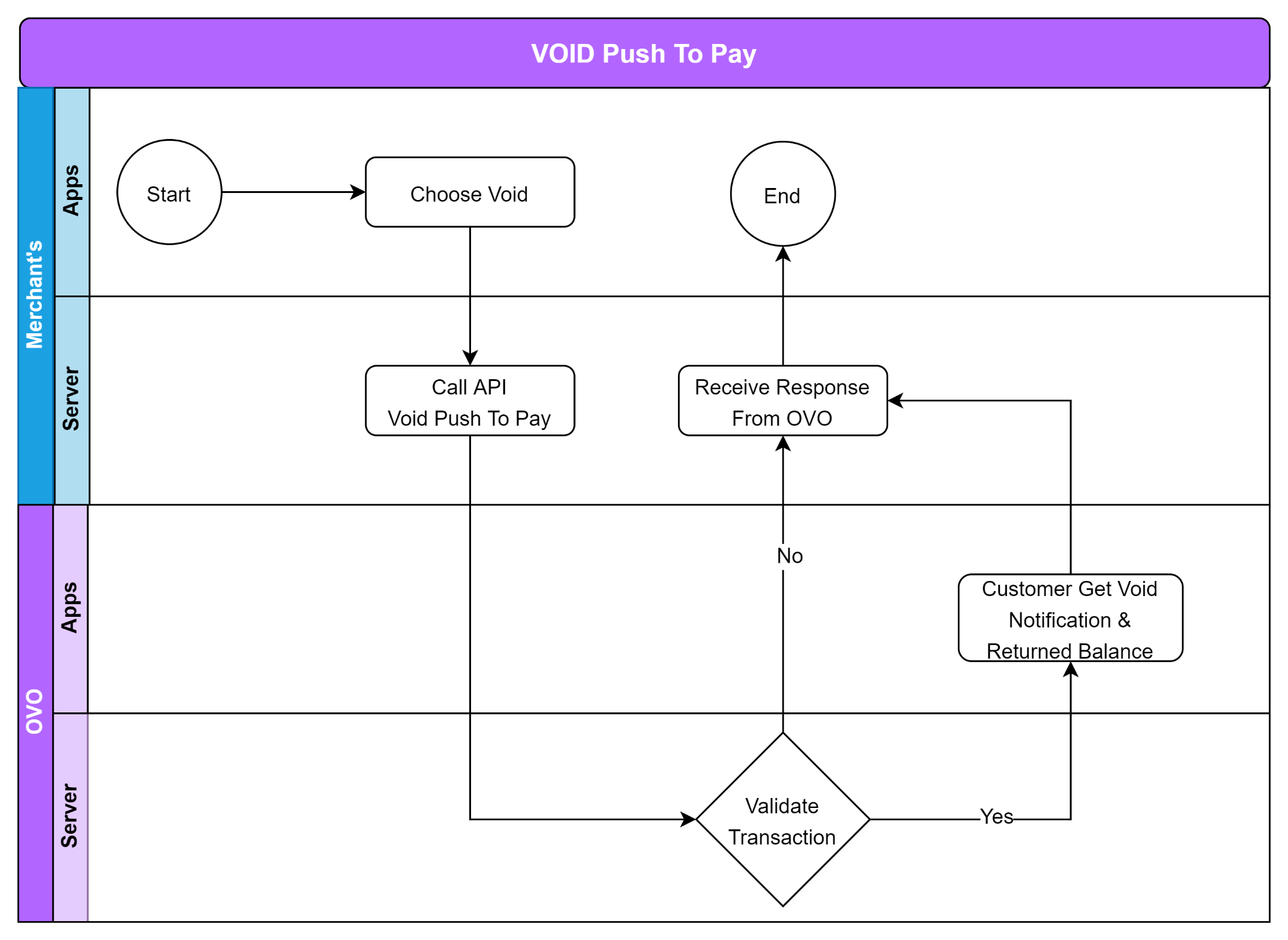

Notes : Void feature only allowed to call before end of day or 23:59:59

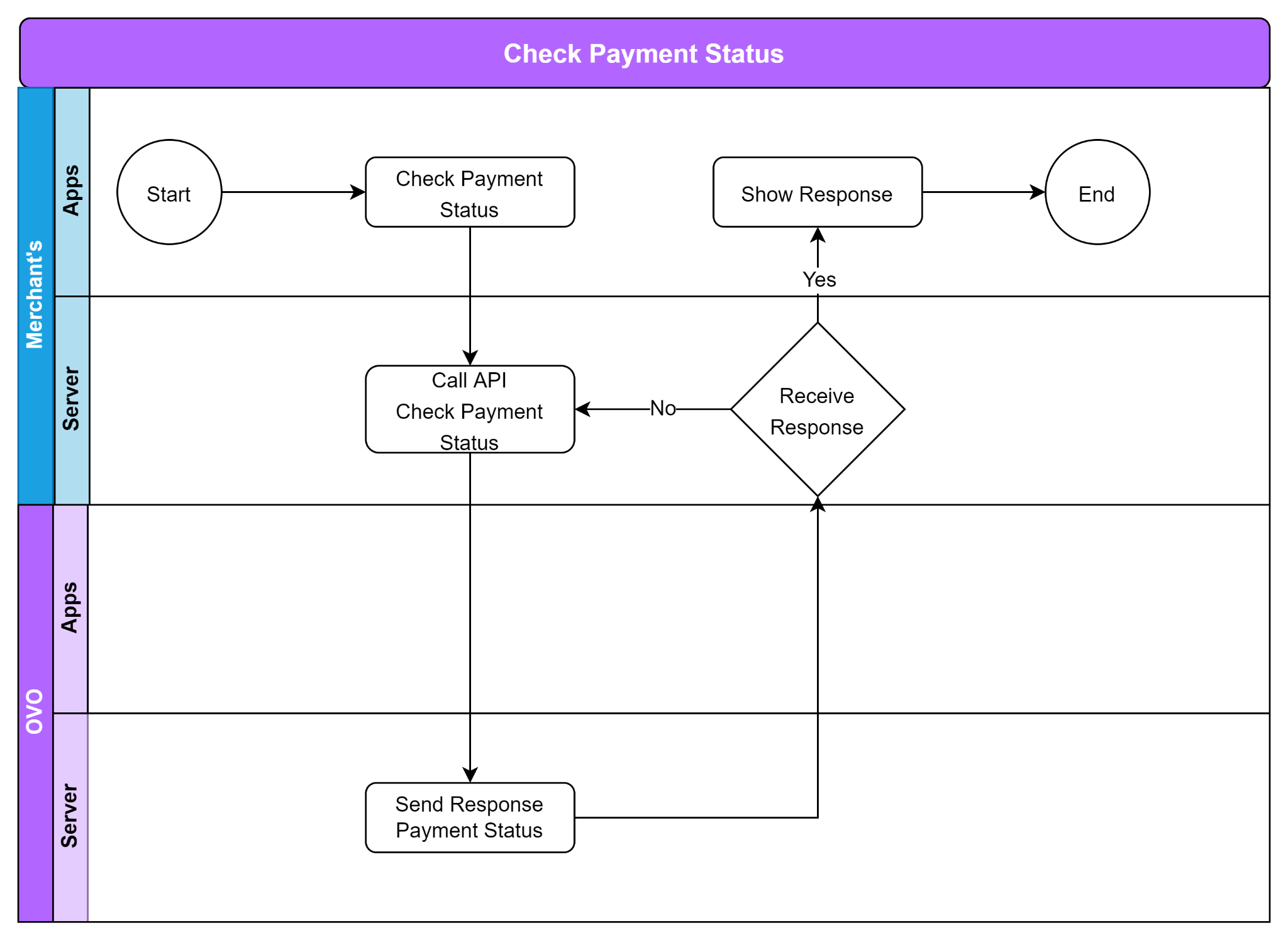

Notes : Please set the interval for check payment status request on 15s if you are not received the response

|

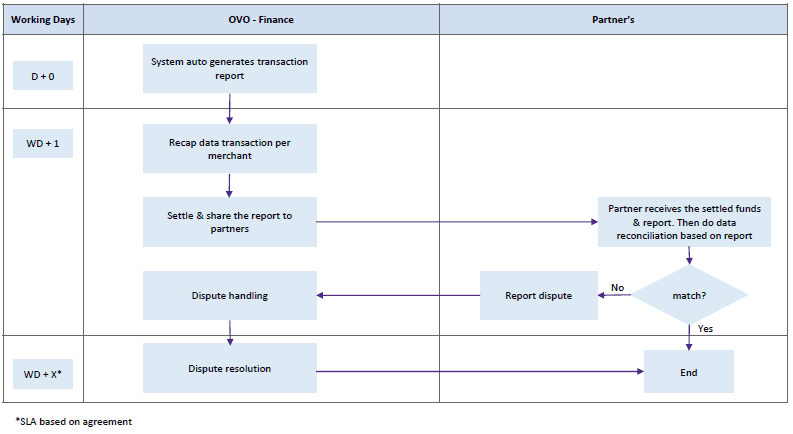

1.Transaction Date

2.Transaction Time 3.Group ID 4.Group Name 5.Merchant ID 6.Merchant Name 7.Store Code 8.Store Name 9.Terminal ID 10.Merchant Invoice* 11.Approval Code 12.Transaction Type 13.Transaction Amount 14.Cash Amount Used 15.OVO Point Used 16.MDR OVO Cash |

17.Nett Amount OVO Cash

18.MDR OVO Point 19.Nett Amount OVO Point 20.OVO Paylater Used 21.MDR OVO Paylater 22.Nett Amount OVO Paylater 23.Savings Amount Used 24.MDR Savings Plus by Nobu 25.Nett Amount Savings Plus by Nobu 26.Nett Settlement 27.Billing ID 28.Reff No 29.Trace No 30.No Rekening Merchant 31.Bank Tujuan 32. …. |

Notes:

Settlement Report Format in Excel (.xlsx)

Merchant invoice auto generated format (id + mid + batch no + reff no + Merchant Invoice)

*Reconciliation key for H2H connection

| Merchant Start Development/Integration | Merchant Go Live |

|---|---|

|

|

| Push to Pay Integration Phase | SLA | PIC | |

|---|---|---|---|

| API Development | TBD | Merchant | |

| UAT | 1 Working Day | OVO & Merchant | |

| Review UAT Result | Up to 2 Working Days | OVO | |

| Create Production Credentials (app-id & app-key) | Up to 3 working days | OVO | |

| Go Live Preparation (Go To Market Meeting) | 1 Working Day | OVO & Merchant | |

| Deployment Production | TBD* | Merchant | |

| Go Live | TBD* | Merchant |

*To be defined